BCH Price August 25

The decline in Bitcoin Cash price from early May continues. This decline has been closely mirrored by the Market Capitalization for the full duration of this interval. Over the shorter-term period of the last month, this correlation is still evident visually, suggesting the two parameters are responding to the same signal.

Coin Telegraph notes that following an SEC decision against authorizing 9 proposed BTC ETFs on August 22, the market didn't react harshly as it has in the past to negative SEC rulings. They reason this suggests this was not a crucial assumption in strategies employed by purely speculative investors.This along with resilience to increased cryptocurrency restrictions in China is taken as a sign by Coin Telegraph that bears are diminishing in control. Bloomberg reports that the GTI VERA Convergence Divergence Indicator is signaling a trend reversal is possible for BTC price. This preceded a 39% increase over the next month the previous time this signal was detected. A predictor of when trends are going to reverse, GTI's indicator, the GTI VERA Convergence Divergence is a modification of Moving Average Convergence Divergence, a standard tool for technical analysis. Coin Telegraph feels that cryptocurrency selling has diminished, citing the fact that the BTC market cap has generally stabilized. This may be relevant due to the Pearson correlation of .8 that Bitcoin Cash price shares with BTC. They go on to point out Bitcoin Cash price has been unable to exceed 600 USD.

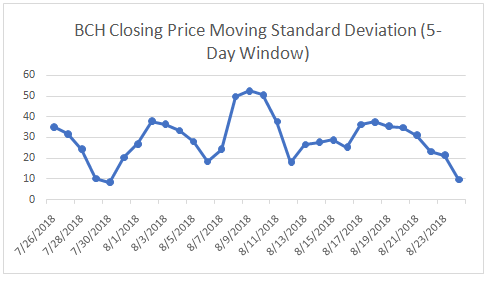

From July 26th to August 24th of 2018, the Standard Deviation for closing Bitcoin Cash price was 113.88 USD.As of August 25th, BCH has a 90-day correlation above .8 with BTC, ETH,XRP, LTC, and several others. The strongest correlation is with Litecoin at .9. The correlation with BTC is .87. Ether’s correlation is .89. BCH is negatively correlated with the S&P 500 at -.17. It has a correlation of .14 with VIX, or the USD. It has a -.14 correlation with gold. These low correlations show that Bitcoin Cash price is poorly coupled to these instruments, positively or negatively, at this time. All P-values for correlations between BCH and other crypto tokens are less than .005, meaning that the statistical significances of the results are on par with that sought by many academic researchers. P-values with SPX, the US dollar and gold are far poorer, the lowest being SPX at .11, gold at .2, and the USD at .2. Given their small correlation amplitudes and the relatively high error for all of them, at best, a reasonable precaution is to view the aforementioned correlations with these traditional instruments as effectively useless.

The Wall Street Journal notes that one BCH was equal to 18% of a BTC in May but that that number is now 8%, which they take as a sign that Bitcoin Cash investors might be switching to BTC. Martin Garcia of crypto-trader Genesis Global Trading Inc. feels that BTC is a stronger brand, and investors are gravitating towards it for that reason.

Another current event worth mentioning is a disagreement over software released by the developer organization Bitcoin ABC intended to bring about a hard fork, which among other modifications, enables atomic swaps, which facilitate the exchange of different tokens without exchange firms. These changes are not welcomed by all BCH proponents, and Craig Wright, the CEO of nChain, is the main figurehead for this latter faction. Though he has not given any evidence, he alleges that he is Satoshi Nakamoto. Along with CoinGeek founder Calvin Ayre, he is proposing a hard fork called Bitcoin SV, which increases block size to 128 MB and foregoes the modifications in Bitcoin ABC. The two forks are incompatible with one another, creating the potential for a chain split in November, when both implementations want to modify BCH’s code.

Wright is controversial in the BCH community, to the extent that Vitalik Buterin harshly criticized him at the Deconomy 2018 Summit in Seoul, calling Bitcoin SV “Bitcoin Craig (BCC),” calling for a strong rebuke of Wright by the BCH community, equating Bitcoin SV to the original BCC, which was the symbol for Bitconnect, a historically prominent Ponzi scheme, and opposing a negotiation with Wright. Weighing in also, the co-founder of Bitmain doesn’t believe that Wright originated Bitcoin and called him “fake Satoshi.” Ethereum World News speculates that if CoinGeek supports him, it could significantly influence the outcome of this conflict. This begs the question whether this conflict will be disruptive to the price of Bitcoin Cash. Ayre intends to dedicate CoinGeek entirely to mining Bitcoin SV and Bitcoin.org’s owner, Cobra, opposes Bitcoin ABC as well.

Several developers from other projects such as Thomas Zander and Andrew Stone, lead developers at Bitcoin Classic and Bitcoin Unlimited, respectively, are skeptical of either of the above forks, specifically feeling that those teams are unwilling to compromise or assimilate feedback, in the case of Zander, and are not acting to benefit the end user, in the case of Stone. Stone thinks for both parties, it is “about power and ego not about technical merit and end-user adoption.” Stone favors keeping the community united.

Coin Telegraph notes that following an SEC decision against authorizing 9 proposed BTC ETFs on August 22, the market didn't react harshly as it has in the past to negative SEC rulings. They reason this suggests this was not a crucial assumption in strategies employed by purely speculative investors.This along with resilience to increased cryptocurrency restrictions in China is taken as a sign by Coin Telegraph that bears are diminishing in control. Bloomberg reports that the GTI VERA Convergence Divergence Indicator is signaling a trend reversal is possible for BTC price. This preceded a 39% increase over the next month the previous time this signal was detected. A predictor of when trends are going to reverse, GTI's indicator, the GTI VERA Convergence Divergence is a modification of Moving Average Convergence Divergence, a standard tool for technical analysis. Coin Telegraph feels that cryptocurrency selling has diminished, citing the fact that the BTC market cap has generally stabilized. This may be relevant due to the Pearson correlation of .8 that Bitcoin Cash price shares with BTC. They go on to point out Bitcoin Cash price has been unable to exceed 600 USD.

From July 26th to August 24th of 2018, the Standard Deviation for closing Bitcoin Cash price was 113.88 USD.As of August 25th, BCH has a 90-day correlation above .8 with BTC, ETH,XRP, LTC, and several others. The strongest correlation is with Litecoin at .9. The correlation with BTC is .87. Ether’s correlation is .89. BCH is negatively correlated with the S&P 500 at -.17. It has a correlation of .14 with VIX, or the USD. It has a -.14 correlation with gold. These low correlations show that Bitcoin Cash price is poorly coupled to these instruments, positively or negatively, at this time. All P-values for correlations between BCH and other crypto tokens are less than .005, meaning that the statistical significances of the results are on par with that sought by many academic researchers. P-values with SPX, the US dollar and gold are far poorer, the lowest being SPX at .11, gold at .2, and the USD at .2. Given their small correlation amplitudes and the relatively high error for all of them, at best, a reasonable precaution is to view the aforementioned correlations with these traditional instruments as effectively useless.

The Wall Street Journal notes that one BCH was equal to 18% of a BTC in May but that that number is now 8%, which they take as a sign that Bitcoin Cash investors might be switching to BTC. Martin Garcia of crypto-trader Genesis Global Trading Inc. feels that BTC is a stronger brand, and investors are gravitating towards it for that reason.

Another current event worth mentioning is a disagreement over software released by the developer organization Bitcoin ABC intended to bring about a hard fork, which among other modifications, enables atomic swaps, which facilitate the exchange of different tokens without exchange firms. These changes are not welcomed by all BCH proponents, and Craig Wright, the CEO of nChain, is the main figurehead for this latter faction. Though he has not given any evidence, he alleges that he is Satoshi Nakamoto. Along with CoinGeek founder Calvin Ayre, he is proposing a hard fork called Bitcoin SV, which increases block size to 128 MB and foregoes the modifications in Bitcoin ABC. The two forks are incompatible with one another, creating the potential for a chain split in November, when both implementations want to modify BCH’s code.

Wright is controversial in the BCH community, to the extent that Vitalik Buterin harshly criticized him at the Deconomy 2018 Summit in Seoul, calling Bitcoin SV “Bitcoin Craig (BCC),” calling for a strong rebuke of Wright by the BCH community, equating Bitcoin SV to the original BCC, which was the symbol for Bitconnect, a historically prominent Ponzi scheme, and opposing a negotiation with Wright. Weighing in also, the co-founder of Bitmain doesn’t believe that Wright originated Bitcoin and called him “fake Satoshi.” Ethereum World News speculates that if CoinGeek supports him, it could significantly influence the outcome of this conflict. This begs the question whether this conflict will be disruptive to the price of Bitcoin Cash. Ayre intends to dedicate CoinGeek entirely to mining Bitcoin SV and Bitcoin.org’s owner, Cobra, opposes Bitcoin ABC as well.

Several developers from other projects such as Thomas Zander and Andrew Stone, lead developers at Bitcoin Classic and Bitcoin Unlimited, respectively, are skeptical of either of the above forks, specifically feeling that those teams are unwilling to compromise or assimilate feedback, in the case of Zander, and are not acting to benefit the end user, in the case of Stone. Stone thinks for both parties, it is “about power and ego not about technical merit and end-user adoption.” Stone favors keeping the community united.

5-Day SMA. Data from CoinMarketCap.

7-Day SMA.Data from CoinMarketCap.

10-Day SMA. Data from CoinMarketCap.

Resources: